Crypto Tax Evasion

Most novice and aspiring crypto traders have managed to get a decent grasp on cryptocurrencies, how they work, and so forth. However, the idea of crypto taxes seems to be just as unnerving as today as it has ever been.

Paying crypto taxes seems to plague even the veterans in the crypto game. Moreover, the Internal Revenue Service (IRS) has managed to create more confusion due to its amorphous rules for crypto.

Table of Contents

How do Crypto taxes work?

Crypto taxes, in a nutshell, are considered assets for tax purposes. Other examples of assets are property and stocks. In other words, cryptocurrencies are taxed the way property is taxed.

It is well-known that anyone who owns property is liable to pay capital gains tax. If you own crypto, you will have to pay capital gains tax. There are two types: short-term capital gains tax and long-term capital gains tax.

Holding your crypto and then selling it after more than a year will require you to pay long-term capital gains tax. However, selling or trading your cryptocurrency within a year from the date of purchase will require you to pay short-term capital gains tax.

When are you supposed to pay your crypto taxes?

Given the confusion that people seem to have around paying crypto taxes and what circumstances require you to pay them, the following should give you a clear idea about the same.

- If you trade your cryptocurrency for a conventional fiat currency such as the US dollar

- If you trade your cryptocurrency for another cryptocurrency. Make sure you calculate the fair market value in dollars at the time of the trade

- If you use your cryptocurrency for the purchase of goods and services

- If you earn your cryptocurrency from mining or other types of earning

When are you not supposed to pay Crypto taxes?

- Giving a third party cryptocurrency as a gift does not require you to pay crypto taxes

- Transferring cryptocurrency between your crypto wallets does not require you to pay crypto taxes

- Buying cryptocurrency using USD or other fiat currencies does not require you to pay crypto taxes

The IRS on Crypto Taxation

It is a bit of an open secret that a big chunk of crypto traders have been evading crypto taxes. They have either not been reporting taxes or not paying them on the gains they get. The Internal Revenue Service (IRS) issued new guidelines for crypto taxes for the first time in six years. This is what the new crypto tax guidelines addresses:

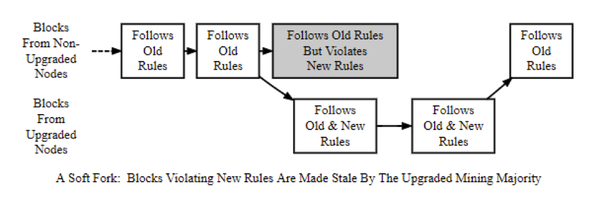

Hard Forks

If you are holding a cryptocurrency that goes through a hard fork, the forked cryptocurrency you receive is liable to be taxed as income. However, you will not have taxable income if you do not receive a new cryptocurrency after a hard fork.

Cost Basis

Crypto traders were in the dark about assigning a cost basis to their crypto assets, prior to the issuance of the new guidelines.

Under the new guidelines, taxpayers are allowed to select the units and cryptocurrency lots they wish to sell at a given time as long as they can identify them correctly and support the cost basis of these units.

Be sure to have the following information ready to identify a cryptocurrency unit accurately

- Date and time when every unit was acquired

- Basis and the fair market value of every unit at the time of acquisition

- Date and time of sale and exchange of every unit

- The fair market value of each unit at the time of sale or trade along with the value of the property or the amount received for each unit

Miscellaneous Taxes (Such as the Robinhood tax)

The 1099 form can be used to pay miscellaneous taxes, including the Robinhood tax. The consolidated 1099 form consists of every reported transaction and all your reported income during the year. It may include the following forms:

- 1099-B

- 1099-DIV

- 1099-INT

- 1099-MISC

- 1099-OID

A Robinhood tax, in a nutshell, is a meager tax on the financial sector, which is said to generate ample amounts of money every year to combat poverty and climate change.

The Robinhood tax is also called a Financial Transaction Tax (FTT). The Robinhood tax is said to be capable of raising close to £250 billion globally every year. Many countries, including the UK, are implementing the Robinhood tax.

Reporting Hard fork on 1099

If you held cryptocurrencies before and during a hard fork event, you could receive one unit of the new cryptocurrency that was created as a result of the hard fork, for every unit of the cryptocurrency that was subject to the hard fork event.

The new cryptocurrency that you receive after the hard fork event is not reported as a transaction in the 1099 form. However, the sale of the cryptocurrency units you receive will have to reported. Also, your cost basis for the cryptocurrency units subjected to the hard fork event may have changed after the same.

Kamran Sharief

Related posts

Sidebar

Recent Posts

The Best Forex Brokers for Beginners

Since COVID-19 first popped up, interest in the forex market has increased dramatically. Knowing how to get involved with minimal…

Maximizing Success: The Symbiosis of Dedicated Software Development Teams and Product Design Services

The Symbiosis of Dedicated Software Development Teams and Product Design Services In the rapidly evolving landscape of technology, businesses aiming…